Moving and taxes. Two small words that instill big-time dread and fear in most people. Moving seems painful because it forces us to go through the piles of things that we have stuffed in closets and shoved in drawers over years and years of living in the same place. Deciding what to keep and what goes before packing it all into boxes seems daunting enough, but then we have to physically move it and spend weeks unpacking it all and reorganizing it in a new space. If moving sounds like torture to you, paying taxes is probably equally painful. All those confusing forms and lines and convoluted instructions and at the end of the exercise you may even have to pay the government more than they already withheld from your paycheck. The good news is, in the midst of a move, the IRS may actually reward you for your efforts in the form of a tax deduction.

Sorting through your belongings and packing them all in nice tidy boxes is enough of a chore, so hiring a professional mover to actually move them from point A to point B could be a great relief AND it might be able to save you some money on your taxes.

Are Your Moving Expenses Tax Deductible?

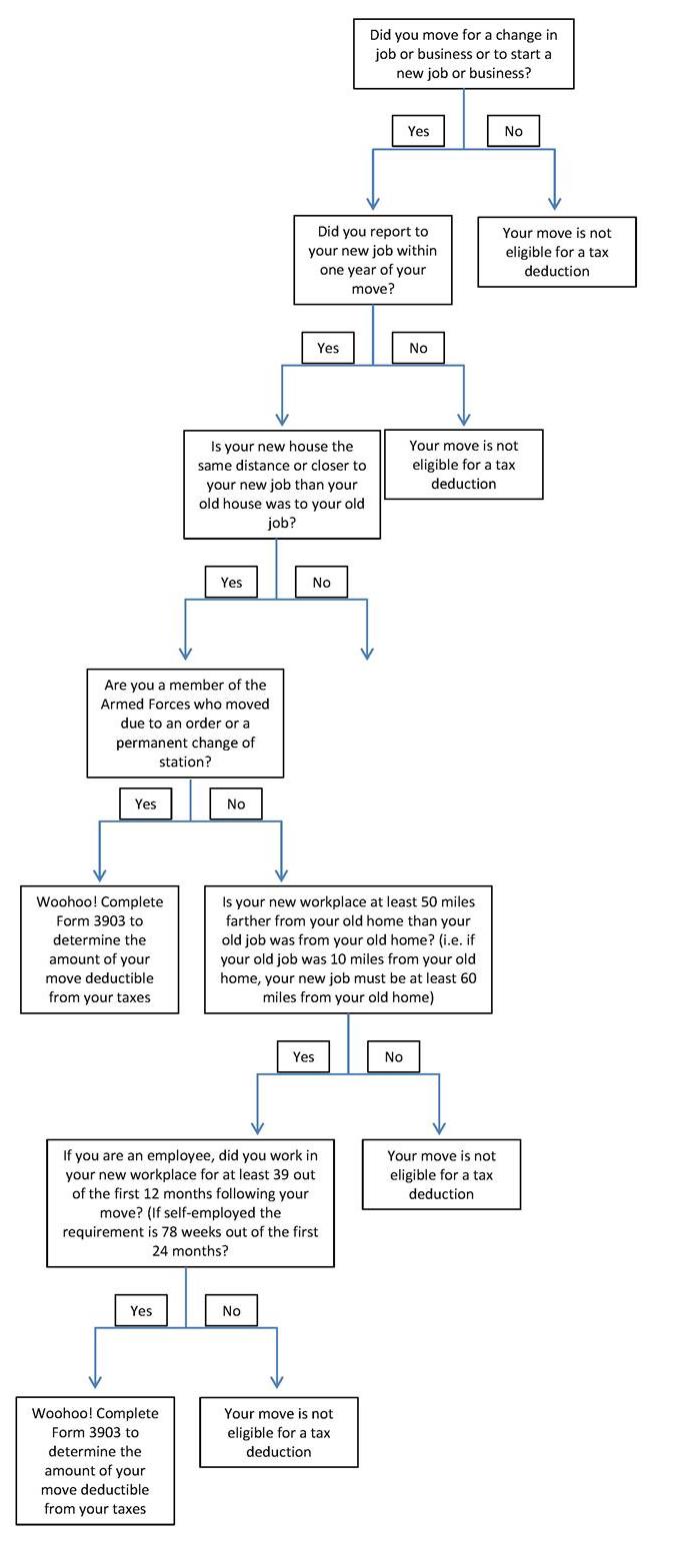

So how are you able to take a deduction on your tax return for moving? Well, the IRS of course has very specific guidelines for this which we will more clearly lay out here:

The above is a flowchart depicting the IRS requirements for deductible moves per IRS publication Topic 455. Here’s a quick run-down:

Moving For A Business Purpose

First off, the IRS wants to determine whether you legitimately moved for business purposes. Unfortunately, if you moved because you wanted to get away from your family or pursue a life-long dream of being a surfer bum, your move probably doesn’t qualify. The IRS will be satisfied that your move was for business purposes if you both start your new job within a year of your move, and your new house is as close to or closer to your new job than your old house was to your old job. In other words, if your new house is 10 miles from your new job and your old house was 12 miles from your old job, you are good to go. If you’re a member of the Armed Forces and you are moving on orders or a permanent change of station, you can stop here. Your move may qualify for a tax deduction.

Distance Test

Plain folk, continue on. Your move must also meet the distance and time tests. Your new workplace must be at least more than 50 miles farther from your old home than your old home was from your old workplace.If you used to live in Westlake, and commuted 5 miles to your old job in downtown Austin, your new job must be more than 55 miles from your Westlake house. So if your new job is in Round Rock, the move doesn’t qualify, but if the new job is somewhere farther away, like Waco, for instance, you’re okay.

Time Test

So you’ve gotten this far – now the time test. If you are an employee, you must work full-time in your new location for at least 39 weeks out of the 12 months following your move. If self-employed, you must work in your new location for 78 weeks out of the first 24 months following your move.

What Moving Expenses are deductible

If you meet all of the qualifications for a deductible move, what moving expenses can you deduct? According to the IRS, the following moving expenses are deductible:

- Travel to your new location. However, keep in mind your route and means of transportation must be reasonable and cannot turn into a mini-vacay touring the country on random backroads and stopping at every tourist trap or sailing from Maine to California via the Panama Canal.

- If driving, you may deduct the cost of gas and oil or you’ll probably find that it’s easier to take the standard deduction of 23.5 cents per mile. Or you can ship your car and deduct the cost of the shipping

- Cost of packing your belongings and transporting them to the new location. This includes the cost of boxes, a professional mover, etc.

- Cost of moving your pets

- Short term storage, not to exceed 30 days prior to moving into your new home

You cannot deduct things like the cost of your new home, home improvements, carpets and drapes, real estate taxes, or anything that you are already deducting as a business expense.

How To Deduct The Moving Expenses On Your Return

Keep receipts of all your moving related expenses for your tax files in case you get selected for an audit. Once you have determined all of your eligible expenses, you will fill out Form 3903. This form is very simple: Put the cost of physically moving your goods (i.e. amount paid to your mover) on line 1 and the cost of travel on line 2. The IRS is adamant that the cost of meals en route to your new location is not deductible. On line 4, you’ll put any amounts paid by your employer from box 12, code P of your W-2 (this includes reimbursements for military moves). You may deduct the cost of any moving expenses that exceed the amount of your reimbursement on page 1, line 26 of your form 1120. This is an adjustment to your adjusted gross income. So, if you spend $10,000 in qualified expenses on your move and receive no reimbursement from your employer, you will take a $10,000 deduction on your return. If you fall in the 30% tax bracket, this means you will save roughly $3,000 on your tax bill ($10,000 x 30%). In effect, your move will only cost you $7,000, since you spent $10,000 and saved $3,000.

Now take a deep breath and call Apple Moving! We won’t be able to give you tax advice, but we’re the experts when it comes to moving your household goods. Whether you’re moving locally, nationally, or internationally, we can help you make the transition.

Do you need help with packing, unpacking, storage, or your entire move?

Request a free rapid quote for any moving services you may need. Get started today!